Understanding the 22 carat gold price in Dubai is crucial for making informed investment decisions. As of August 29, 2024, the price stands at 282.25 AED per gram. This figure serves as a vital reference point for both local and international investors.

Gold holds a significant place in the investment landscape due to its reputation as a stable and tangible asset. Monitoring gold prices allows investors to capitalize on market trends and optimize their portfolios. For instance, observing fluctuations—in this case, an increase from around 289 to 304.50 AED per gram over the past month—can signal opportunities or risks.

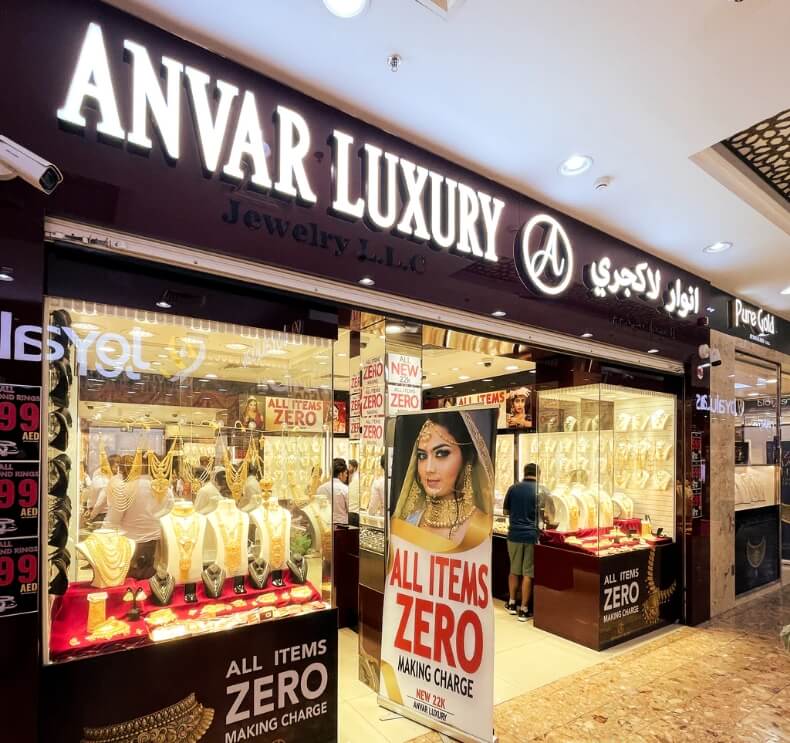

The gold market in Dubai is renowned globally, often referred to as a major hub for gold trading. The city’s strategic location, tax-free policies, and well-established infrastructure attract buyers from all corners of the world. Retail locations like the iconic Dubai Gold Souk offer a wide array of gold products, making it easier for consumers to stay updated with real-time prices.

Investing in 22 carat gold in Dubai presents numerous benefits due to competitive pricing and high quality standards, solidifying Dubai’s position as a premier destination for gold trading and investment.

Factors Influencing Gold Prices in Dubai

Several key factors influence gold prices in Dubai:

Global Market Trends and Demand-Supply Dynamics

Gold prices are heavily impacted by global market trends. When international investors flock to gold as a safe haven during economic uncertainties, prices tend to rise. Conversely, when confidence in other assets like stocks or bonds increases, gold prices may decline.

- Demand and Supply: The availability of gold from mining operations and recycled gold impacts supply levels. High demand periods, such as during festivals or wedding seasons in countries like India, can drive up prices.

Local Economic Conditions

Economic stability within the UAE also plays a crucial role. Stable economies often lead to stronger local currencies, influencing purchasing power and investment flows into gold. During times of economic instability or inflation, investors might turn to gold as a more secure asset.

Currency Exchange Rates

The AED’s exchange rate against major currencies such as USD and INR significantly affects gold pricing for international buyers.

- AED to USD: Since the UAE dirham (AED) is pegged to the US dollar (USD), fluctuations in the USD directly impact gold prices in Dubai. A stronger USD typically makes gold more expensive for buyers using other currencies.

- AED to INR: For Indian buyers, the AED to INR conversion rate is critical. A favorable exchange rate can make 22 carat gold more affordable for Indian consumers, boosting demand and possibly increasing local prices.

Understanding these factors helps investors navigate market fluctuations effectively and make informed decisions about purchasing 22 carat gold in Dubai.

The Popularity of 22 Carat Gold Among Buyers

Cultural Significance

22 carat gold holds a special place in the hearts of many buyers, especially among Indian and other Asian communities. This purity level, containing 91.7% gold, is preferred for its balance between durability and purity, making it ideal for crafting intricate jewelry pieces. Indian customers, in particular, have a deep-rooted cultural affinity for 22 carat gold, often buying it for weddings, festivals, and other significant life events. This tradition isn’t just about aesthetics; it’s also seen as a way to preserve wealth across generations.

Key Retail Locations

Dubai stands out as a premier destination for purchasing 22 carat gold due to its diverse retail options and competitive prices. One of the most iconic locations is the Dubai Gold Souk. Located in Deira, this bustling marketplace features over 300 retailers specializing in gold jewelry. Here, you can find everything from traditional designs to contemporary pieces, catering to the diverse tastes of international buyers. Stores in the Dubai Gold Souk offer real-time updates on gold prices, ensuring transparency and competitive rates.

Other notable retail spots include major shopping malls like The Dubai Mall and Mall of the Emirates, where high-end jewelers offer an extensive array of 22 carat gold products. These locations provide a blend of luxury shopping experiences with the assurance of quality and authenticity.

Jewelry Preferences

The preference for 22 carat gold isn’t limited to its cultural significance; it also aligns with practical considerations. Its durability makes it suitable for everyday wear while maintaining a high level of purity that appeals to investors and collectors alike. In Dubai, you can find an array of jewelry items made from 22 carat gold:

- Necklaces

- Bracelets

- Earrings

- Rings

Each piece reflects both traditional craftsmanship and modern design trends, making Dubai a hub for exquisite 22 carat gold jewelry that meets various stylistic preferences.

Understanding these factors helps you appreciate why 22 carat gold remains a popular choice among buyers in Dubai.

Ensuring Quality and Authenticity When Buying Gold in Dubai

Dubai Central Laboratory plays a crucial role in maintaining purity standards for gold sold in the region. This laboratory ensures that every piece of gold, including 22 carat gold, meets stringent quality guidelines, protecting consumers from substandard products.

To verify the authenticity of 22 carat gold before making a purchase, consider these tips:

- Look for Hallmarks: Genuine 22 carat gold should have a hallmark indicating its purity level.

- Request a Certificate: Ask the seller for a certificate of authenticity that details the purity and weight of the gold.

- Use Trusted Retailers: Purchase from reputable retailers like those in the Dubai Gold Souk, known for their adherence to quality standards.

- Check Reviews: Online reviews can provide insights into other buyers’ experiences with specific retailers.

Ensuring these steps can help you make informed decisions and secure high-quality gold investments.

Investing in Gold: Advantages and Considerations for Investors in Dubai

Investing in physical gold offers numerous advantages as a long-term investment within Dubai’s thriving marketplace. One of the primary benefits is the stability and security that gold provides; it serves as a hedge against inflation and currency fluctuations. Physical gold, such as 22 carat gold, remains a tangible asset that you can hold, store, and eventually sell when needed.

Key Benefits:

- Hedge Against Inflation: Gold typically retains its value over time, making it an effective buffer against economic instability.

- Global Liquidity: Gold is universally recognized and can be easily traded or sold across international markets.

- Cultural Significance: For many buyers, especially from Asian communities, 22 carat gold holds cultural importance, increasing its desirability.

Considerations for Investors:

Before purchasing 22 carat gold, conducting thorough market analysis is crucial. You should monitor daily price trends and understand the factors driving price changes. For instance:

- Global Market Trends: International events, geopolitical tensions, and economic policies can influence gold prices.

- Demand and Supply Dynamics: Seasonal demand spikes during festivals or wedding seasons can affect prices.

- Currency Exchange Rates: AED to USD and INR conversions can impact the cost for international buyers.

Potential risks such as price fluctuations must also be considered. While gold is generally stable, short-term volatility can occur due to speculative trading or sudden shifts in market sentiment.

By staying informed about these factors, you can make well-timed investments that maximize returns while minimizing risks.

Conclusion

Staying informed about 22 carat gold prices in Dubai can significantly enhance your investment opportunities. Conducting thorough research and practicing due diligence are crucial when navigating this dynamic market. Keep a close watch on market trends and fluctuations to make well-informed decisions, ensuring you maximize the potential of your gold investments.