Gold has been important to humans for centuries. It’s not just attractive, but also a reliable investment option. Throughout history, gold has been seen as a symbol of wealth and stability, which is why many people choose to protect their assets by investing in it.

Investment in gold offers various choices:

- Physical Gold: Coins, bars, and jewelry.

- Financial Instruments: Exchange-Traded Funds (ETFs) and mutual funds.

Investing in physical gold gives you something you can hold, while financial instruments are easier to manage and convert into cash.

Diversifying your investments is crucial for a strong portfolio. Including gold can help reduce the risks that come with unpredictable market changes and economic downturns. Gold’s ability to maintain its value over time makes it an effective way to protect against inflation and currency devaluation. Adding gold to your investment plan can make your portfolio more resilient overall.

1. Why Invest in Gold

Gold as a Hedge Against Inflation

Gold has long been seen as a reliable way to protect against inflation. Unlike paper currencies, which can lose value due to economic policies and inflationary pressures, gold holds its value over time. When inflation rates go up, the purchasing power of paper money goes down, but gold usually keeps or even increases its value. This makes it an attractive choice for investors who want to safeguard their wealth from the effects of inflation.

Gold as a Safe-Haven Asset

During times when the stock market is unpredictable and there’s economic instability, gold often becomes a safe-haven asset. Investors turn to gold when they’re not confident in financial markets, which drives up its price. Looking at past information, we can see that gold prices tend to go up during political tensions, recessions, and financial crises. This unique ability to perform well in tough situations makes gold an important part of a diversified investment plan that aims to reduce risk.

Preserving Wealth with Gold

Compared to paper currencies, which can lose value because of government policies and economic downturns, gold is effective at preserving wealth. Central banks all around the world hold large amounts of gold because it’s a stable way to store value. Owning physical gold or investing in gold-related financial products lets individuals protect their assets from currency devaluation and keep their purchasing power for a long time.

Investing in gold is a strong strategy for preserving wealth, protecting against inflation, and ensuring financial stability during uncertain times.

2. Different Ways to Invest in Gold

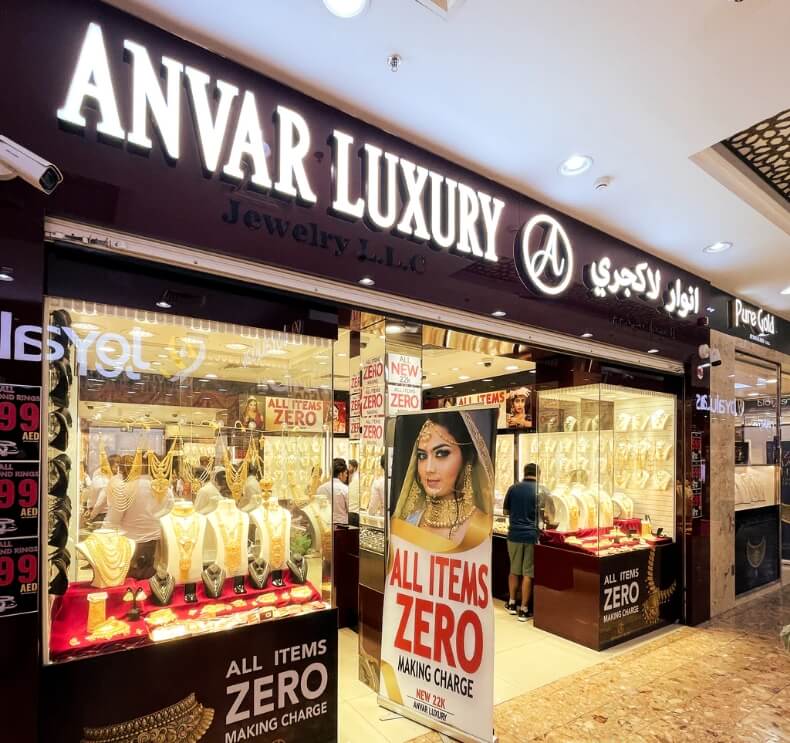

Physical Gold

Investing in physical gold can take several forms, such as coins, bars, and jewelry. Coins and bars are popular due to their high purity levels and ease of storage. Jewelry, although aesthetically pleasing, often includes additional costs for craftsmanship and may not be as pure.

Advantages:

- Tangibility: Physical gold is a tangible asset you can hold.

- Intrinsic Value: It holds intrinsic value and is universally recognized.

Challenges:

- Storage and Security: Requires secure storage solutions to prevent theft.

- Liquidity: Selling physical gold can sometimes be less straightforward compared to financial instruments.

Gold-Related Financial Investments

Gold-related financial investments include mining stocks and futures contracts.

Mining Stocks:

- Represent shares in companies involved in gold extraction.

- Can offer high returns but come with company-specific risks.

Futures Contracts:

- Allow you to buy or sell gold at a predetermined price on a future date.

- High potential for returns but also high risk due to market volatility.

Gold ETFs and Mutual Funds

Gold ETFs (Exchange-Traded Funds) and mutual funds provide an accessible way to invest in gold without the need for physical storage.

Benefits:

- Accessibility: Easily bought and sold through stock exchanges.

- Liquidity: Highly liquid, making it simple to enter or exit positions.

- Diversification: Often include a mix of different gold-related assets, spreading out risk.

Investors find these vehicles attractive due to their simplicity, lower fees, and the ability to track the performance of gold without dealing with physical assets.

3. Understanding the Risks and Considerations

Price Volatility

Investing in gold comes with inherent price volatility. Gold prices can fluctuate due to various factors such as geopolitical tensions, changes in interest rates, and economic data releases. To navigate this volatility, adopting a long-term perspective is crucial. Historical data demonstrates that gold tends to hold its value over extended periods, making it a reliable hedge against inflation and market instability.

Allocation Recommendation

Incorporating gold into your investment portfolio requires a strategic approach:

- Risk Tolerance: Assess your individual risk tolerance. If you are risk-averse, a smaller allocation might be appropriate.

- Financial Goals: Align your gold investments with your financial objectives. For instance, if preserving wealth is a priority, a more substantial allocation could be justified.

- Portfolio Diversification: Experts generally recommend allocating no more than 10% of your portfolio to gold. This ensures you benefit from its protective qualities without being overly exposed to its price swings.

By considering these factors, you can make informed decisions and optimize the role of gold within your broader investment strategy.

Conclusion

Investing in gold can be a strategic move for securing your financial future. By considering the benefits of gold as a hedge against inflation and a safe-haven asset, you can enhance the resilience of your investment portfolio. Gold’s ability to preserve wealth over the long term makes it a valuable addition for those looking to diversify.

Before making any investment decisions, it’s crucial to weigh the risks associated with gold’s price volatility. A well-thought-out allocation strategy, tailored to your risk tolerance and financial goals, can help you navigate these challenges effectively. By doing so, you can make informed decisions that align with your long-term financial objectives and contribute to a secure financial future through gold investments.